Get the free note and deed of trust

Show details

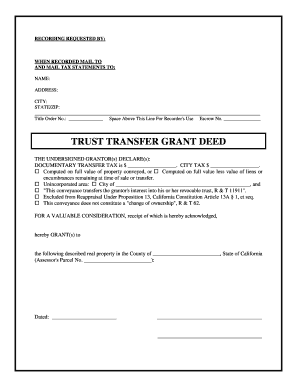

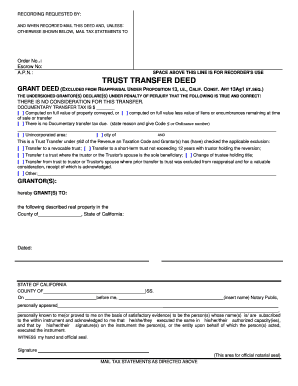

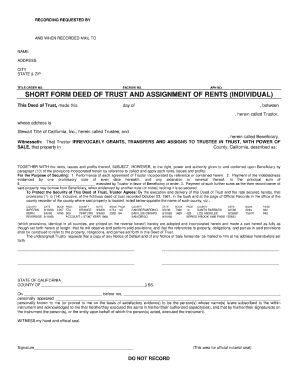

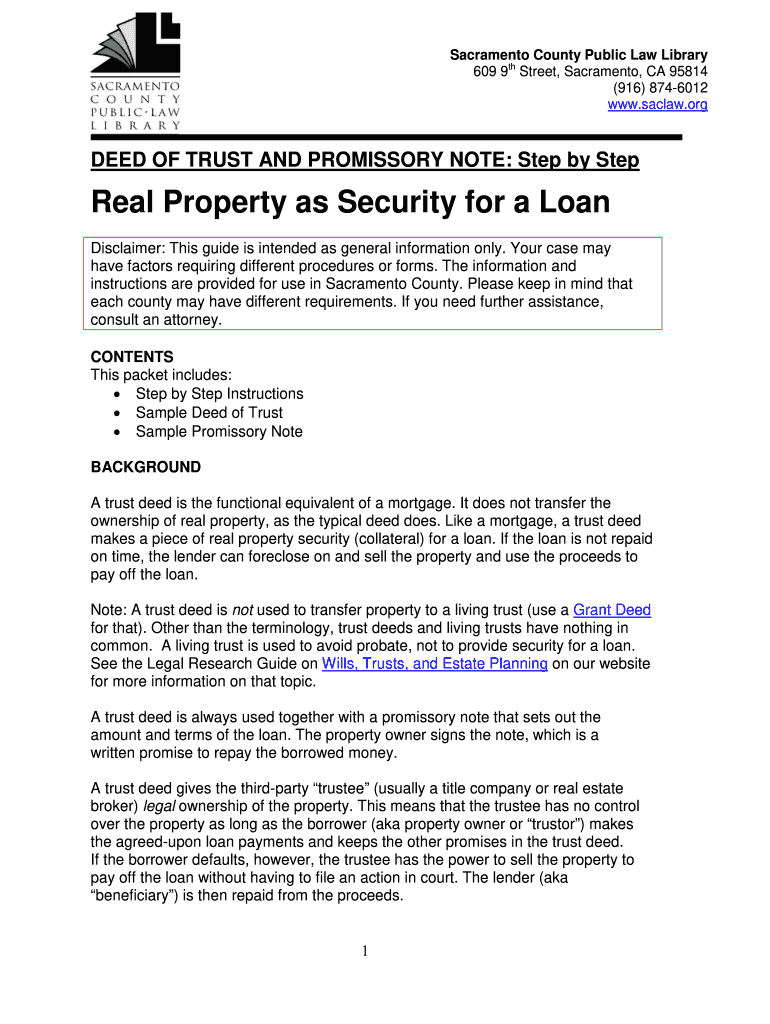

Sacramento County Public Law Library 813 Sixth St., Sacramento, CA 95814 (916) 874-6012 www.saclaw.org DEED OF TRUST AND PROMISSORY NOTE: Step by Step Real Property as Security for a Loan Disclaimer:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign promissory note secured by deed of trust template form

Edit your pdffiller form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your deed trust form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing example of deed of trust online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit deed of trust form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

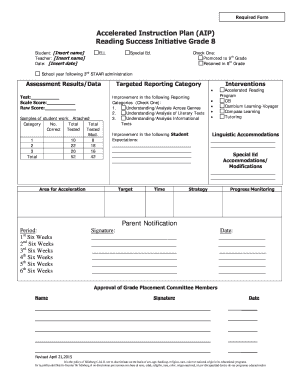

How to fill out note secured by deed of trust form

How to fill out deed of trust form?

01

Start by gathering all necessary information and documents such as property address, legal description, lender's name and contact information, borrower's name and contact information, and any other relevant details.

02

Carefully read through the instructions provided with the deed of trust form to understand the requirements and steps involved in filling it out.

03

Begin filling out the form by entering the date at the top and any other required identification details such as the county and state where the property is located.

04

Include the names and addresses of all parties involved in the transaction, including the lender, borrower, and trustee (if applicable). Double-check the spelling and accuracy of the information.

05

Provide a detailed description of the property being pledged as collateral. Include the address, lot number, block number, and any other specific information required. This section should accurately describe the property to avoid any confusion.

06

Indicate the terms of the loan or obligation, including the principal amount, interest rate, payment terms, and any other relevant details. Ensure that all financial information is accurately recorded.

07

If there will be a trustee involved in the transaction, include their name, address, and contact information. Specify their powers, duties, and responsibilities as outlined in the trust agreement.

08

Carefully review all the filled-out sections to ensure accuracy and completeness. Make sure all necessary signatures are obtained and dates are included where required.

09

Make copies of the completed deed of trust form for all parties involved and retain the originals for record-keeping purposes. It is recommended to consult with a legal professional or seek legal advice if you have any concerns or questions during the process.

Who needs deed of trust form?

01

Property owners who are borrowing money and using their property as collateral typically need a deed of trust form.

02

Lenders or financial institutions requiring a legal document to secure their interest in the property.

03

Trustees, if applicable, who need to enter into an agreement to hold the property's title on behalf of the lender until the loan obligation is satisfied.

04

Any individual or entity involved in a real estate transaction where a legal document is necessary to establish a lien on the property as security for a loan or obligation.

Fill

mortgage deed of trust

: Try Risk Free

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete what is a deed of trust online?

Completing and signing note deed of trust online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How can I edit mortgage deed of trust example on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing deed of trust, you need to install and log in to the app.

How do I fill out trust deed using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign deed of trust template and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is deed of trust form?

A deed of trust form is a legal document that secures a loan by placing a lien on the property being financed, allowing the lender to foreclose on the property if the borrower defaults.

Who is required to file deed of trust form?

The borrower, or the trustor, is typically required to file the deed of trust form with the appropriate county office to ensure the lender's interest in the property is legally recorded.

How to fill out deed of trust form?

To fill out a deed of trust form, include details such as the names of the borrower and lender, a description of the property, the loan amount, and the terms of the trust. Ensure all parties sign the document in front of a notary.

What is the purpose of deed of trust form?

The purpose of a deed of trust form is to provide security for a loan by using the property as collateral, detailing the rights and responsibilities of both the borrower and lender.

What information must be reported on deed of trust form?

The deed of trust form must report the identities of the borrower and lender, the property description, the loan amount, interest rate, repayment terms, and signatures from both parties.

Fill out your note and deed of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Promissory Note And Deed Of Trust is not the form you're looking for?Search for another form here.

Keywords relevant to promissory note deed of trust

Related to sample deed of trust california

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.